BVI Financial Services Commission Asia Representative Office

All incorporation, license, certificate, and other post-incorporation inquiries in the Asia-Pacific Region are handled by the BVI Financial Services Commission Asia Representative Office.

FSC Asia Rep. Office

https://www.bvifsc.vg/bvi-asia-representative-office

https://www.bvifsc.vg/services

https://www.bvifsc.vg/contact-us-0

Email: HKservice@bvifsc.vg

Tel: (852) 3468 8504

Fax: (852) 3107 0019

Become a Licensee

Obtaining a Licence to Conduct Trust and Company Management Business in the BVI

In order to conduct trust and company management business in the British Virgin Islands, a licence must be obtained by making an application to the Financial Services Commission. The Banks and Trust Companies Act, 1990 provides for the following categories of licence:

- A Class I trust licence, for the purposes of carrying on trust business and company management business;

- A Class II trust licence, for the purpose of carrying on trust business only;

- A Class III trust licence, for the purpose of carrying on company management business only;

- A Class II trust licence may be issued as a restricted Class II licence, in which case the holder of the licence shall not undertake trust business other than in connection with those trusts, not exceeding fifty, listed in a sworn undertaking; and

- A Class III trust licence may be issued as a restricted Class III licence, in which case the holder of the licence shall undertake no company management business, other than the provision of directors and officers, and nominee shareholders, for Virgin Islands companies.

Any person wishing to submit an application to the Commission in respect of a licensed business activity must do so by utilizing the Approved Forms and Related Guidelines. Applicants for a trust licence are required to complete the following forms:

(i) General Part – Application for a Licence or Certificate as a Financial Services Business Provider;

(ii) Part 1 – Application for a Licence or Certificate as a Financial Services Business Provider;

(iii) Part 2 – Additional Information Required in the case of a Banking or Fiduciary Business Licence Application;

(iv) Part 5 – Additional Information the Applicant wishes to Provide; and

(v) Part 6 – Declaration.

Preparing to apply for a licence

To apply for a licence, an applicant must complete the approved application forms. However, a significant amount of work is required before an applicant is able to complete and submit a satisfactory application.

An applicant may wish to consider the following steps before completing the application forms:

- Decide the type of business they wish to conduct and therefore the category of licence they wish to apply for;

- Download the following documents:

- Prepare a business plan in accordance with the requirements of the Regulatory Code, 2009. The following sections of the Regulatory Code are also relevant:

- Part I Principles for Business

- Part II Division 1 - Licensing

- Part II Division 2 – Fit and Proper Criteria (see Regulatory (Amendment) Code, 2010 regarding amendments to Fit and Proper Criteria)

- Part II Division 3 – Management and Control

- Part II Division 4 – Compliance

- Part II Division 5 – Outsourcing

- Part II Division 6 – Financial Statements, Audit

- Part II Division 7 – Customer Assets

- Part II Division 8 – Other Obligations and Restrictions

- Part V – Trust Companies and Company Management Companies (applicants that wish to operate as a Managed Trust Company must be guided by Additional Licensing Criteria [Managed Trust Companies] Explanatory Notes (xxx) - (xxxvi) of the Regulatory Code, 2009 and meet the requirements of Part V Division 2 – Managed Trust Companies)

- Determine how corporate governance requirements will be met (who will be resident directors, senior officers, compliance officer, money laundering reporting officer, etc).

Preliminary Discussions with the Commission

Prior to submitting an application, applicants are also encouraged to hold preliminary discussions with the Financial Services Commission. Such discussions help to ensure that the potential applicant understands the licensing process and requirements and enable the Commission to identify significant issues of concern. The potential applicant then has an opportunity to take actions to deal with these concerns prior to submitting its formal application.

Submitting an Application

Applications must be received through an authorized British Virgin Islands Registered Agent or Legal Advocate. A directory of Registered Agents is published on the Commission’s website.

As a courtesy, a directory of Legal Advocates is also published on the Commission’s website. The BVI Financial Services Commission does not endorse or recommend the entities named on the list neither are these entities subject to regulation by the Commission.

Before submitting an application, it is imperative that the Registered Agent or Legal Advocate review it for completeness, that is, to ensure that it meets ALL the requirements of the Approved Forms and Related Guidelines, the Regulatory Code, 2009, the Guidelines for the Approved Persons Regime, the Anti-Money Laundering and Terrorist Financing Code of Practice, 2008 (and its Amendments), The Anti-Money Laundering Regulations, 2008 (and the Amendments) and other relevant legislation and guidelines.

Applicants should not rely on the Commission’s review process to identify errors and omissions in their application. Incomplete applications may be returned to the applicant.

Fees

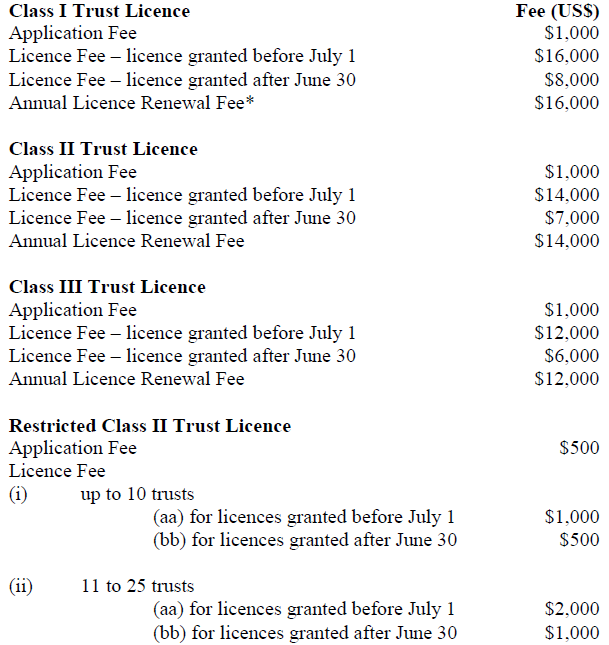

A non-refundable application fee must accompany an application for a licence (see Financial Services Commission (Fees) Regulations, 2010) and Financial Services Commission (Fees) (Amendment) Regulations, 2010. An application will not be processed if the fee is not received.

Application fees, licence fees and annual licence renewal fees are given below. Fees are subject to change; applicants must ensure that fees are submitted in accordance with the Financial Services Commission (Fees) Regulations, 2010. Annual Licence Renewal Fees are payable no later than 31st January of each year.

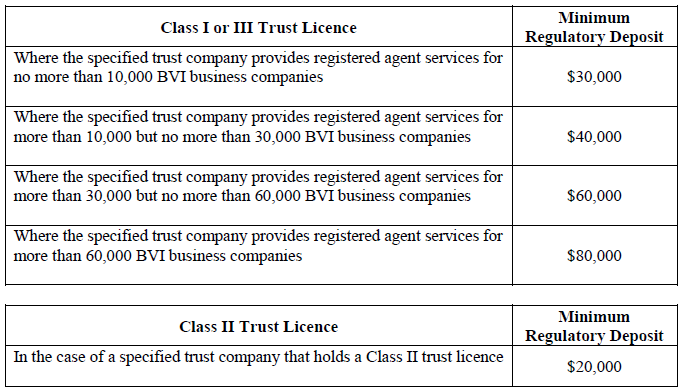

Regulatory Deposit

Sections 156 and 157 of the Regulatory Code prescribe the deposits required to be made by licensees under section 12(4)(b) of the Banks and Trust Companies Act, 1990 and the manner in which regulatory deposits are to be made and retained by the Commission. Furthermore, those sections specify the purposes for which a regulatory deposit may be utilised by the Commission. The relevant explanatory notes are also useful.

An applicant must pay the required regulatory deposit before the licence is granted. In the case of an applicant for a Class I or a Class III trust licence, the minimum regulatory deposits are given below. The maximum regulatory deposit is $100,000.