The BVI remains at the forefront of international corporate structuring for cross-border transactions and investing worldwide. Characteristics such as a familiar legal system based on English common law, internationally compliant regulations and tax neutrality make it an especially attractive jurisdiction for pooling capital globally and investing it in markets where legal barriers or political risks would otherwise deter investment.

Initial Public Offerings

Since Asia’s economies started opening up to the world, Asian and Chinese businesses have looked to the BVI as a platform to access international capital.

In addition to being eligible to list on worldwide stock exchanges, including the London Stock Exchange (LSE), LSE’s AIM Exchange, the New York Stock Exchange (NYSE), NASDAQ, International Securities Exchange, the Toronto Stock Exchange and the Singapore Stock Exchange, BVI companies can now also list on the Hong Kong Stock Exchange (SEHK).

BVI companies enjoy access to a streamlined process to list in Hong Kong – they do not need to face burdensome restructuring requirements for their businesses or redomicile their place of incorporation.

Additionally, the BVI does not impose a double layer of tax and regulation on a listed BVI company. For example, there is no BVI takeover code or public filing requirement applicable to listed companies, which ensures that the incorporation and ongoing costs of using a BVI company are low, while high standards are maintained as required by the International Organisation of Securities Commissions (IOSCO), of which the BVI is a member.

Lastly, BVI companies are extremely flexible in their structure and handling. The constitution of a BVI-listed company can be easily amended to reflect any required shareholder protection provisions so that they suit the client and target investor base. These include disclosure of director interests, authority for issuance of shares, independent valuation for issuance of shares for non-cash consideration, and retirement of directors by rotation.

Case Study

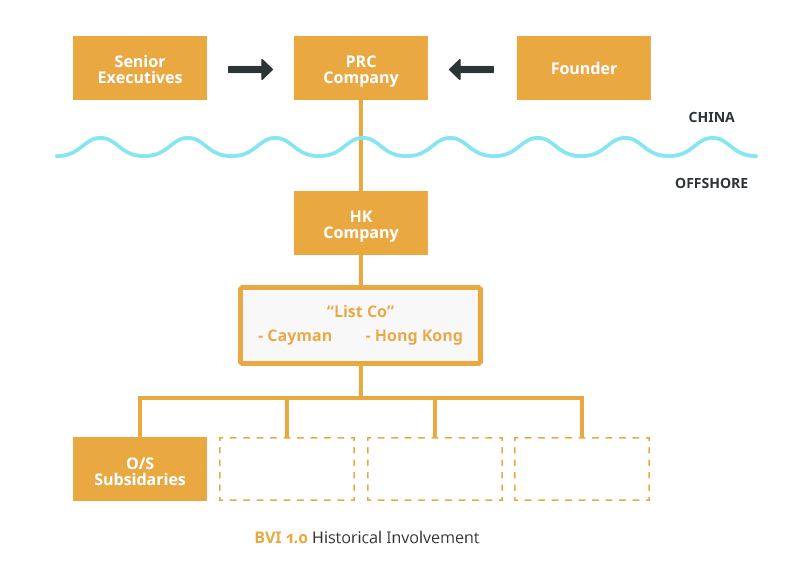

Traditionally, BVI would have played a minority role in this type of case. The Founder would probably have retained his stake in the PRC company on-shore, and similarly, if there was an executive share plan, this would be in the form of directly held shares in the China Company, on-shore, incurring more costs and reducing flexibility.

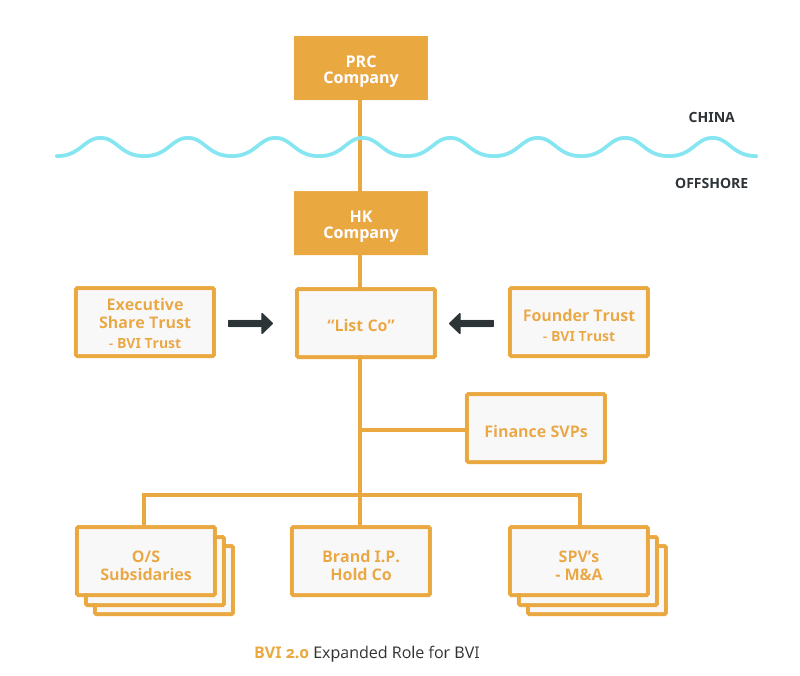

However, with BVI as an approved listing entity on the Hong Kong Stock Exchange, the BVI has taken a greater role beyond only playing a holding company by providing a much better, more efficient structure for the Founder, the Executives and the Listed company, reducing costs and administrative burden.

- The Founder shares can be held by a BVI trust, with a professional trustee managing the affairs of the trust. This gives far stronger asset protection, is more flexible in terms of distributing assets to beneficiaries, and gives protection against forced heirship or creditor action against the PRC company.

- Similarly, the Executive Share Plan is now managed within a BVI trust structure, allowing the entry and exit of executives in the scheme without the administrative work associated with direct shareholdings. As the funds are held offshore, this gives the Founder and the Executives the ability to invest overseas with potential tax and liquidity benefits.

- Furthermore, licensing the Chinese company’s brand or trademarks and using a BVI vehicle to act as a holding company for these assets can give greater legal protection and cost advantages to how the overseas operations are run.

- If the company intends to be active in overseas expansion through M&A, then BVI can be used for the Financing Entity to which banks lend to allow these transactions. As companies are acquired overseas, the BVI can be used as the acquiring entity with potential benefits in lowering transaction costs

BVI IPO Facts

- BVI-incorporated companies are listed on major stock exchanges around the world.

- The majority of Chinese companies incorporated outside of China and listed in Hong Kong (also known as red-chip stocks) have BVI holding companies. As of July 2014, there were 125 red-chip stocks on the SEHK, representing a market capitalisation of HK$5.1 trillion, including Bank of China Hong Kong and CITIC Pacific.

- A study which included a sample of 72 listed Chinese companies found that nearly 60 percent had one or more BVI holding companies.

- Tianhe Chemicals Group Ltd., China’s largest producer of lubricant oil and leading global producer of specialty chemicals, listed on the SEHK in June 2014, raising US$654 million, representing the largest SEHK listing of a BVI company.

- Winsway Enterprise Holdings Ltd. (formerly Winsway Coking Coal Holdings), one of the largest integrated suppliers of high-quality coal in China, was the first BVI-incorporated company to be listed on the SEHK in October 2010.

- In 2014, Russian hypermarket chain Lenta Ltd. dual-listed on the London and Moscow Stock Exchanges, creating the largest publicly listed BVI company with a current market capitalisation of US$5.3 billion.

Mergers and Acquisitions

BVI Business Companies (BCs) have been synonymous with offshore vehicles for many Asian and Chinese investors since the 1980s. The volume of new incorporations of BCs from the Asia Pacific region has underpinned the growth of the BVI as a corporate domicile. This increase in incorporations is exemplified by the profile of existing BVI companies represented on stock exchanges around the world, providing those companies with critical access to capital required to fund acquisitions.

Because BCs operate efficiently and with a high level of corporate flexibility, BCs are frequently used to structure transactions. For example, a BVI company can merge with one or more BVI or foreign companies, and the surviving company of the merger can be the company incorporated in a foreign jurisdiction. This provides great flexibility for structuring mergers and acquisitions (M&As) and cross-border deals.

The BRICS economies of Brazil, Russia, India, China and South Africa continue to strongly support BVI M&A activity. In China, the substantial balance sheets of Chinese state-owned banks, such as China Development Bank and Bank of China, have been driving M&A activity in China, and Chinese lenders are expected to continue to play a key role in driving M&A financing activity in Asia.

The flexible merger scheme in the BVI has been successfully utilised for a number of transactions for companies in the Asia Pacific region.

M&A Case Studies

- The large number of existing BVI companies in Asia means that BVI companies are especially favoured by Chinese mainland corporations and individuals in building overseas structures.

- U.S. fast-food chain Burger King Worldwide Inc. and Canadian coffee and doughnut chain Tim Hortons Inc. agreed to a US$11.4 billion M&A deal to expand their coffee segment in August 2014. This novel merger followed the NYSE listing in June 2012 of Justice Holdings Ltd., indirect parent of Burger King Holdings, which is incorporated in the BVI.

- Trinity Ltd., part of Li & Fung, the world’s largest supplier to consumer brands, in April 2012 acquired BVI company Gieves and Hawkes International – the iconic Savile Row tailor whose most celebrated customers include the Duke of Wellington – and its business from Hong Kong-listed Wing Tai Properties.

- China Daye Non-Ferrous Metals Mining Ltd. acquired BVI company Prosper Well Group Ltd. in 2012 for HK$6.8 billion. The controlling shareholder, Daye Nonferrous Metals Co. Ltd., owns substantial copper mines in Hubei province, central China, and is principally engaged in the production and sale of copper cathodes, gold and silver.

- LJ International Inc., incorporated in the BVI and listed on NASDAQ, was acquired and taken private by a consortium led by the chairman for approximately US$64 million. LJ is a leading coloured gemstone and diamond jeweler with retail and wholesale business in China. The transaction shows the flexibility and adaptability of the BVI merger legislation and reinforces the suitability of BVI companies as listing vehicles.